Client Management: Comprehensive Client Report

The Comprehensive Client Report feature in CaseCentral provides detailed insights into client-related metrics, facilitating informed decision-making and strategic planning.

Here’s how it handles key aspects

- Accounts Receivable

The Accounts Receivable feature in CaseCentral enables efficient management of financial transactions and client accounts.

Key Fields:

* **Company:** Identify transactions associated with specific companies.

* **Report Date:** Specify the date range for financial reporting.

* **Finance Book:** Classify financial transactions for accurate accounting.

* **Cost Center:** Allocate expenses and revenues for financial performance tracking.

* **Party Type:** Classify transaction parties (e.g., customers, vendors).

* **Party:** Specify individuals or entities involved in transactions.

* **Party Account:** Manage transactions associated with specific party accounts.

* **Ageing Based On:** Analyze receivables or payables based on ageing criteria.

* **Client:** Track financial interactions related to specific clients.

* **Customer:** Analyze financial data related to customer transactions.

* **Customer Group:** Classify customers for segmentation and financial analysis.

* **Payment Terms Template:** Standardize transaction terms and conditions.

* **Sales Partner:** Track and analyze sales performance by partners.

* **Sales Person:** Evaluate sales contributions and performance by personnel.

* **Territory:** Segment financial data based on geographical regions.

#### cr1

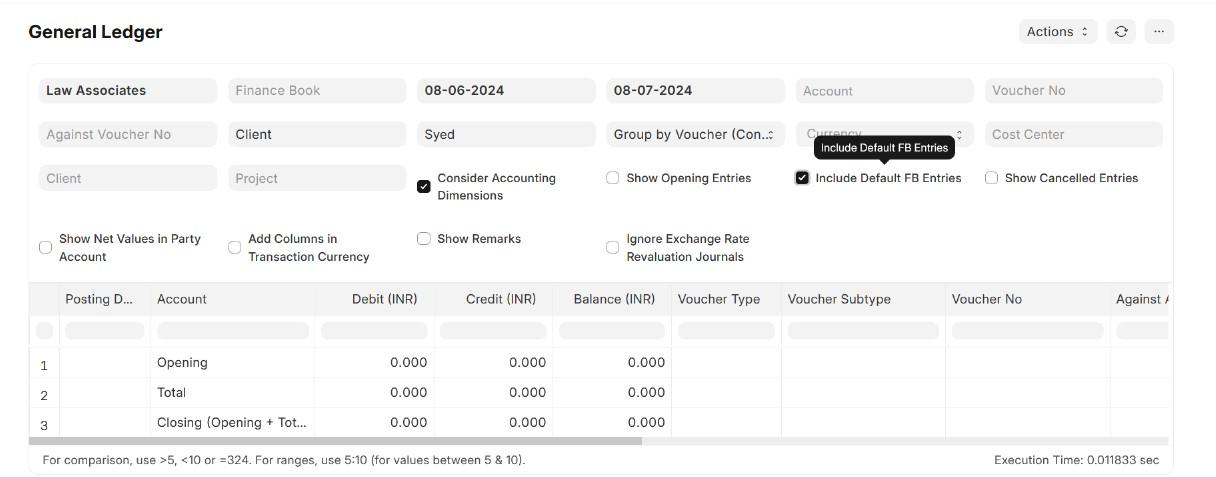

2. Accounts Ledger

The Accounts Ledger feature complements Accounts Receivable by maintaining accurate records of financial transactions and client interactions.

Key Fields:

* **General Ledger:** Record and classify all financial transactions comprehensively.

* **Company:** Identify transactions associated with specific companies.

* **Finance Book:** Classify financial transactions for accurate reporting.

* **From Date:** Start date for the ledger entry.

* **To Date:** End date for the ledger entry.

* **Account:** Specify the account related to the financial transaction.

* **Voucher No.:** Unique identifier for each transaction voucher.

* **Against Voucher No.:** Reference to the voucher against which the transaction is recorded.

* **Party Type:** Classify transaction parties (e.g., customers, vendors).

* **Party:** Specify individuals or entities involved in transactions.

* **Group By:** Organize ledger entries based on selected criteria.

* **Presentation Currency:** Currency used for presenting financial information.

* **Currency:** Currency of the financial transaction.

* **Cost Center:** Allocate expenses and revenues for financial performance tracking.

* **Client:** Track financial interactions related to specific clients.

### Generating Reports

These fields are integrated into CaseCentral's reporting functionalities to facilitate:

* **Customized Reporting:** Tailor reports based on selected fields to meet specific business needs and requirements.

* **Analysis and Insights:** Gain valuable insights into financial performance, client relationships, and operational efficiencies.

* **Decision Making:** Support strategic decision-making processes with accurate and timely financial information.

Implementation in CaseCentral

The Accounts Receivable and Accounts Ledger features are seamlessly integrated into the platform's financial management capabilities:

- Usage: Access real-time data on receivables and ledger entries to monitor financial health and client interactions.

- Integration: Integrate data from accounts receivable and ledger reports into comprehensive dashboards and financial analytics tools within CaseCentral for deeper insights and financial planning.

These features empower organizations to maintain robust financial control, optimize cash flow, and enhance client relationships through transparent and efficient financial management practices.